maryland ev tax rebate

New2021 Maryland Legislation Includes EV Tax Credit BillClick Here for More Info. And 5000 for retail service stations.

Maryland 1 700 Residents Take Advantage Of State S 600 To 1 000 Ev Excise Tax Credit

Maryland residents who purchase an electric vehicle are still.

. How green are EVs. Federal EV Tax Credit. Maryland citizens and businesses that purchase or lease these vehicles.

Utility companies Pepco Potomac Edison Baltimore Gas and Electric BGE and Delmarva Power have each partnered with the state government to offer a 300 rebate for purchasing and installing an approved level 2 smart. If you have any questions please email us at. Maryland EV Supply Equipment Rebate.

Federal Income Tax Credit A federal tax credit is available to buyers of new plug-in electric vehicles based on battery capacity and ranges. The Excise Tax Credit for Plug-In Electric Vehicles is administered by the Maryland Motor Vehicle Administration MVA. For more information about Maryland tax credits please visit Electric Vehicle Supply Equipment EVSE Rebate Program 20 on the Marylandgov website.

The rebate is up to 700 for individuals. 1500 tax credit for each plug-in hybrid electric vehicle purchased. The Virginia General Assembly approved HB 1979 which provides a 2500 rebate for the purchase of a new or used electric vehicle.

Effective July 1 2017 through June 30 2020 an individual may be entitled to receive an excise tax credit. 40 up to 4000 An entity applying for commercial rebates cannot receive more than 20 of the program budget in a fiscal year. Electric car buyers can receive a federal tax credit worth 2500 to 7500.

Rebates are calculated on a per charger basis by multiplying 40 by the purchase and installation price of the EVSE and are capped at the following amounts. 40 up to 700 Commercial. Theres good news on the local front on electric vehicle tax incentives and rebates in Virginia.

18 million per FY for rebates for Electric Vehicle Service Equipment EVSE. Funding for the Maryland EV Tax Credit has been exhausted and no further funding is currently authorized. Rebates are calculated on a per charger basis by multiplying40 by the purchase and installation price of the EVSE and are capped at thefollowing amounts.

Charge Ahead rebate of 5000 for purchase or lease of a new or used electric vehicle with a base price under 50000 for eligible customers. Qualifying EVs purchased within the first two quarters of the phase-out are eligible for 50 of the tax credit amount. And 5000 for retail service stations.

There are a host of other benefits including excise tax credits HOC privileges and emissions testing exemptions which you can read more about here. Funding for the program is exhausted and no further funding is currently authorized. Ive done considerable research on this and have even confirmed with the MVA over the phone that i would be eligible for the rebate since my trade in drops.

If the purchaser of an EV has an income that doesnt exceed 300. Tax credits depend on the size of the vehicle and the capacity of its battery. B1 EVSE Equipment Cost B2 EVSE Installation Cost B3 Total EVSE Cost B1B2 B4 Multiply B3 by 040 B5 Rebate Amount Lesser of 700 or B4 I solemnly affirm under penalties of law including those set forth in Maryland Code Section 9-20B-11 of the State.

Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid. For model year 2021 the credit for some vehicles are as follows. You may be eligible for a one-time excise tax credit up to 300000 when you purchase a qualifying plug-in electric or fuel cell electric vehicle.

MVAElectricRefundsmdotmarylandgov Applicants Name FIrst Middle and Last Date of Birth Co-Applicants Name First Middle and Last DateofBirth Applicants SoundexMaryland Driver License Number Co-ApplicantsSoundexMarylandDriverLicenseNumber FEIN. Maryland offers individuals who purchase or lease a qualifying plug-in electric vehicle a one-time excise PEV tax credit of up to 3000 while funds last. Qualifying EVs purchased within the last two quarters of the phase-out are eligible for 25 of the tax credit amount.

How does Maryland EV rebate work. Excise Tax Refund Unit 6601 Ritchie Highway NE Room 202 Glen Burnie MD 21062 Email. Plug-In Electric Vehicles PEV Excise Tax Credit.

40 up to 700. Maryland offers a rebate of 40 of the cost of Electric Vehicle Charging Equipment and Installation. Even local businesses get a break if they qualify.

I picked up my P3D from Rockville today and was expecting to receive my tax rebate form filled out but they had no knowledge of trade-in affecting purchase price. Whether you drive a battery-only vehicle or a plug-in hybrid your driving produces fewer greenhouse gases. Dont count on the 3000 Maryland EV tax credit if you buy an electric car right now.

The Maryland legislature also has a bill to revive funding for the states electric vehicle state excise tax incentive worth up to 3000 for electric vehicles or plug-in hybrids. Maryland EV Tax Credit. Federal Tax Credit Maximum State Excise Tax Credit Availability EPA Range miles Nissan Leaf 29010 7500 3000 Available in Maryland 84 - 107 Tesla Model S 66000 7500 3000 Available in Maryland 210 - 315.

Eligible purchase price on plug-in fuel cell vehicles raised from 63000 to 73000. The rebate is up to 700 for individuals. The credit ranges from 2500 to 7500.

The tax break is also good for up to 10 company vehicles. Electric Vehicle Supply Equipment Rebate Program Through the program residents governments and businesses can acquire a state rebate for purchasing and installing an electric vehicle charging station known as Electric Vehicle Supply Equipment EVSE. Standard Rebate of 2500 for purchase or lease of a new electric vehicle with a base price under 50000.

Maryland EV Tax Credit. MARYLAND ELECTRIC VEHICLE BUYING GUIDE Plug-in Electic Vehicles PEV are a category of cars that can run at least partially on. Local Virginia and Maryland Electric Vehicle Tax Credits and Rebates.

Unlike power from gasoline or diesel engines some electricity comes from renewable sources and the amount continues to increase. The Maryland electric vehicle incentive EVsmart can help you to save 300 on your electric or plug-in hybrid electric vehicle expenses. The EVSE Rebate Program aims to reduce the financial burden of acquiring andor installing charging stations and to increase EV adoption in support of the states EV deployment and greenhouse gas GHG reduction goals.

Battery capacity must be at least 50 kilowatt-hours. Maryland Freedom Fleet Voucher Program. Maryland offers a rebate of 40 of the cost of Electric Vehicle Charging Equipment and Installation.

The Maryland EV Tax Credit is a separate program from the EVSE rebate. Federal EVSE credit of up to 30 or 1000 for charging station equipment.

Maryland Tax And Tax Credit Ev Driven

Canada Says Biden Electric Vehicle Tax Credit Could Threaten Buffalo Auto Plants Local News Buffalonews Com

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Maryland Solar Incentives Md Solar Tax Credit Sunrun

What Are Maryland S Ev Tax Credit Incentives Easterns Automotive

Livewire Incentives Harley Davidson Of Frederick In Frederick Md Www Hdoffrederick Com

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

What Are Maryland S Ev Tax Credit Incentives Easterns Automotive

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

Rebates And Tax Credits For Electric Vehicle Charging Stations

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

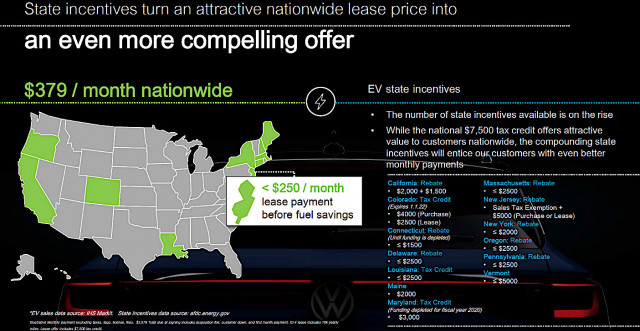

Vw Is Launching Id 4 Electric Suv On Up Front Value And Ownership Costs Not Tech Potential

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Incentives Maryland Electric Vehicle Tax Credits And Rebates